When you first hear about online real estate investing, it might sound like a scam or a tech startup’s fever dream.

Especially when people talk about things like blockchain or tokenized real estate.

Being skeptical is a good thing. Otherwise, you might fall for flashy promises, and that rarely ends well. And it’s natural to resist something that feels both new and oddly complicated.

But well, here we are in 2025. Many apps help people invest in property online.

For example, Binaryx. Recognized by EU-Startups as one of the most promising startups, this platform lets you invest in parts of properties and earn rental income without ever stepping foot in a building.

Let’s take a look at the main ways to invest in real estate online and trusted platforms for every type of investor.

6 proven ways to invest in real estate online & get passive income

There are many ways to invest in real estate online, and plenty of platforms that make it easy to get started.

1) Tokenized real estate platforms

Tokenized real estate uses blockchain to turn properties into digital tokens that anyone can buy. This makes investing much more accessible — you don’t need to buy a whole house or deal with tons of paperwork. Instead, you can invest small amounts in real estate from around the world and earn income from your share.

Famous platforms include Binaryx, where you can earn up to 16.3% annual rental return, and RealT, which focuses on U.S. rental properties and pays daily income in crypto.

2) Real estate crowdfunding platforms

Crowdfunding platforms let lots of people pool money together to invest in real estate. It’s an easy way to get into larger projects like apartment buildings or office spaces without needing a big budget. You also get the benefit of a diversified portfolio without managing the property yourself.

Some well-known platforms include Fundrise, which starts at just $10 and is open to everyone. CrowdStreet is for accredited investors and focuses on big commercial projects. RealtyMogul offers both REITs and individual property deals.

3) Real estate investment trusts (REITs)

REITs allow you to invest in portfolios of real estate assets through publicly traded shares. You earn dividends from the income produced by the properties without ever owning them directly. Instead of buying properties yourself, you buy shares in a company that owns a bunch of income-producing buildings. You earn dividends from rent and profits, and you can invest without worrying about tenants or repairs.

You can buy REIT shares on platforms like Public.com, a beginner-friendly app that lets you invest in the stock market, including REITs. Streitwise offers private REITs focused on commercial buildings with steady dividend payouts. Fundrise also offers eREITs — digital REITs built for modern investors with low minimums.

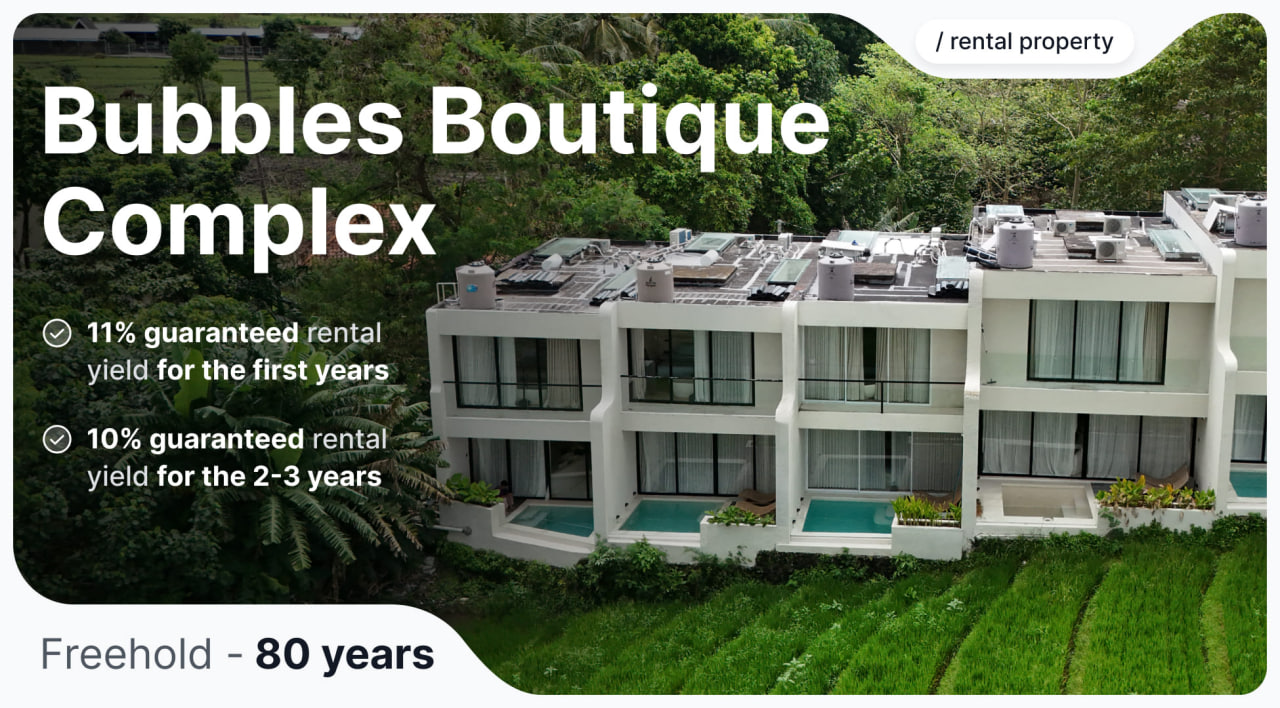

4) Rental property marketplaces

These platforms help you buy ready-to-go rental homes, usually with tenants already living there and property managers in place. It’s a great way to earn rental income passively, without having to deal with being a landlord.

Popular options include Roofstock, which offers single-family rentals with performance data and financing help. Mynd (formerly HomeUnion) gives a full service, from buying the home to managing it. Doorvest lets you buy rental properties completely online and even handles the renovations and tenants.

5) Fractional ownership platforms

Fractional ownership lets multiple investors co-own a property. You all split the rental income and future profits. It’s a simple, lower-cost way to get into real estate — and some platforms let you invest with just $500.

You can try Arrived if you want a hands-off way to earn from rental homes — they pay dividends quarterly. Lofty AI offers daily rental income and lets you buy or sell your shares whenever you want. Fractional is a social investing platform where you can team up with friends or the public to invest together.

6) Virtual real estate (metaverse)

Virtual land is sold in digital worlds where users can build, monetize, or flip properties. It’s still very experimental, but could become a big market as VR and AR evolve.

For example, Decentraland, where you can own virtual land, throw events, or set up digital shops. The Sandbox adds a gaming twist, letting you build and trade digital assets. Otherside, created by the Bored Ape Yacht Club team, is promising more immersive metaverse experiences with real estate-like features.

How to invest in real estate online: step-by-step

Online real estate investing has opened the doors for anyone to get started, whether you’ve got $500 or $10,000. With just a few clicks, you can invest in real estate from your phone or laptop.

Step 1: Understand your options

Before you put any money in, it’s important to know what types of online real estate investments are out there.

As we discussed in the first chapter, there are six main ways to invest in real estate online, including tokenized real estate platforms, real estate crowdfunding, REITs (real estate investment trusts), rental property marketplaces, fractional ownership platforms, and virtual real estate in the metaverse — each offering different levels of risk and returns.

Step 2: Set your budget and risk level

Now, think about how much money you’re willing to invest and how much risk you’re okay with. Some platforms let you start with just $500, while others require $1,000 or more.

Are you looking for steady income each month? Or do you want to invest for long-term growth? Do you want to stay hands-off or be more involved in choosing properties?

Your answers will help narrow down the best types of investment strategies and platform for you.

Step 3: Choose the right platform

Once you know your goals and budget, start looking for a platform that matches. For passive income and low starting amounts, check out real estate investing apps like Binaryx or Arrived.

If you're focused on property appreciation, commercial real estate platforms like CrowdStreet may be a better fit. If you want to spread your money across multiple projects, a REIT through apps like Robinhood or E*TRADE could work well.

Also, make sure to check if you need to be an accredited investor (usually only for higher-income earners) or if the platform is open to everyone.

Step 4: Do your research about investment opportunities and understand risks

Real estate investing isn’t without risks. Property values can go up or down, and it may not always be easy to get your money out quickly.

Always look into how the platform works, what fees they charge, and what kind of returns they’ve delivered in the past.

Read reviews, check their terms, and be sure you understand how your money is being used. A good platform should be transparent and give you clear info about every investment.

Step 5: Start small and diversify your portfolio

It’s smart to begin with a small amount so you can learn how the platform works without too much pressure.

As you get more comfortable, you can invest more and spread your money across different properties, asset types, or even different platforms. This helps lower your risk and gives you more chances to earn.

Don’t put all your money into one deal. Think of it like planting a few seeds instead of betting everything on one tree.

Step 6: Keep track of your investments

After you invest, keep an eye on how things are going. Most platforms have dashboards where you can see your returns, rental income, and updates on the properties.

Check in now and then to make sure your investments are performing the way you expected. It’s also a good idea to follow real estate trends and news, so you stay informed and ready to make smart moves.

Top online real estate investing apps in 2025

Whether you're just getting started or looking to add something new to your portfolio, there's a setup that fits your budget, risk level, and goals.

1. Binaryx Platform

Binaryx has become a go-to platform for beginner and long-term real estate investors. It is the first diversified investment platform created by Ukrainians to help people grow their capital and earn passive income. All properties are listed on the marketplace, and investors can purchase them in fractions.

The platform offers access to reliable properties that generate stable rental income and grow in value over time, like land in Bali, which has increased by 30% in just two years.

Investors can reinvest every $25–$50 earned, invest in multiple properties at once, and complete the entire process from sign-up to investment in under five minutes.

Binaryx also has a big community of over 70,000 people across X (Twitter), Discord, YouTube, Telegram, and Medium. It brings together both beginners and experienced investors, offering helpful resources and support.

- Minimum investment: $50

- Investor eligibility: Open to both accredited and non-accredited investors

- Investment types: Tokenized real estate assets (residential and commercial)

- Key features: Buy property shares through blockchain, earn passive income, and trade ownership freely

- Best for: Investors interested in blockchain-based real estate ownership with low entry barriers

2. Fundrise

Fundrise became popular due to its low $10 minimum and intuitive user experience. It offers a range of investment types, including eREITs and private real estate funds, all bundled into diversified portfolios.

Open to non-accredited investors, Fundrise provides access to professionally managed assets with solid historical returns.

It’s ideal for those who want to passively build real estate wealth without managing individual properties.

- Minimum investment: $10

- Investor eligibility: Open to both accredited and non-accredited investors

- Investment types: eREITs, private real estate funds, venture capital, and private credit

- Key features: Low entry barrier, diversified portfolios, and an intuitive platform

- Best for: Beginners and long-term passive investors

3. Arrived

Arrived makes it easy for everyday investors to buy fractional shares of rental homes with as little as $100.

The platform handles all the heavy lifting—from buying and renovating homes to finding tenants and managing properties—while investors earn a share of rental income and potential appreciation.

It's a simple, passive option for people looking to invest directly in real estate without becoming landlords. Arrived is particularly useful for those who want real asset exposure without a high upfront cost.

- Minimum investment: $100

- Investor eligibility: Open to non-accredited investors

- Investment types: Fractional ownership in single-family rental homes

- Key features: Earn rental income and potential property appreciation without property management responsibilities

- Best for: Investors seeking direct exposure to rental properties with minimal capital

4. CrowdStreet

CrowdStreet connects accredited investors with high-end commercial real estate deals across the U.S., often with minimums starting at $25,000.

The platform gives access to institutional-grade projects, from office buildings and industrial parks to large apartment complexes.

Each listing includes detailed financials, projected returns, and developer backgrounds, making it a strong option for investors seeking direct involvement in large-scale deals. CrowdStreet is ideal for experienced investors ready to go big in commercial real estate.

- Minimum investment: Typically $25,000

- Investor eligibility: Accredited investors only

- Investment types: Commercial real estate projects across the U.S.

- Key features: Access to institutional-grade real estate deals

- Best for: Experienced investors seeking larger-scale commercial opportunities

5. RealtyMogul

RealtyMogul offers a flexible platform for investing in both REITs and individual commercial properties. With minimums ranging from $5,000 to $35,000, it caters to both non-accredited and accredited investors.

You can choose from debt or equity opportunities and diversify across property types, including office, retail, and multifamily.

The platform’s hybrid model gives investors a choice between fully passive REITs or more hands-on property selections, making it suitable for a wide range of strategies.

- Minimum investment: $5,000 for REITs; $35,000 for individual properties

- Investor eligibility: REITs open to non-accredited investors; individual properties for accredited investors

- Investment types: REITs and individual commercial properties

- Key features: Offers both equity and debt investments

- Best for: Investors looking for a mix of REITs and direct property investments

6. Yieldstreet

Yieldstreet goes beyond traditional real estate by offering access to a wide array of alternative investments, including art, legal settlements, and private credit—alongside property-based assets.

While most offerings are reserved for accredited investors, some are available to everyone. With a focus on asset-backed investments and risk-adjusted returns, Yieldstreet appeals to those who want to diversify their portfolios beyond stocks and bonds.

It's a compelling platform for investors looking to explore less conventional but potentially high-yield opportunities.

- Minimum investment: Varies by offering

- Investor eligibility: Primarily for accredited investors; some offerings for non-accredited investors

- Investment types: Alternative assets, including real estate, art, and legal finance

- Key features: Diversified alternative investment opportunities

- Best for: Investors seeking exposure to a variety of alternative assets

Why traditional investment properties can be a pain

Getting into real estate the old-fashioned way isn’t easy. There are a lot of things that make it harder than people expect—and for many, it's enough to stop them from trying at all.

It’s really expensive at the start

You usually need a big chunk of money just to get in the game. Between the down payment and other costs, most people can’t afford to invest unless they’ve saved up for years.

Getting a loan is a hassle.

Mortgages come with piles of paperwork and slow approvals. Lenders want perfect credit, proof of income, and a lot of back-and-forth. It’s not fun, especially if your financial history isn’t spotless.

You can’t get your money out quickly

If you want to sell your property, it could take months. And it’s not just the wait—you’ll also pay fees, deal with agents, and sign a bunch of documents. So if you need fast cash, selling real estate probably won’t help.

Being a landlord is real work

Managing a rental property means fixing stuff, dealing with tenants, and covering costs when the place is empty. It can be stressful and unpredictable. Some places even have rent rules that limit how much you can earn.

It’s hard to spread your money around

Want to invest in more than one property? That takes even more cash, more loans, and more effort. For most people, that kind of portfolio just isn’t realistic.

Real-life example: how a $20,000 investment on Binaryx could earn you $3,147 in one year

Let’s say you invest $20,000 and split it into four different real estate projects on Binaryx. Some of these properties are already bringing in rental income, while others are still under construction and expected to grow in value. Here’s how it could look:

- $5,000 in Kammora Living Rental Villa in Bali: This rental property offers a 12% annual percentage return (APR). With an initial investment of $5,000, you could earn $600 in the first year. While it’s currently sold out, you could still purchase tokens from other users on the Binaryx P2P market.

- $5,000 in Hayat Green Tower in Antalya, Turkey: This property guarantees an 8% rental return, which would bring you $400 in income for the first year. Although it’s also currently sold out, tokens may be available for purchase from other investors via the P2P market.

- $5,000 in Bingin Magic Story Villa in Bali (under construction): This villa is being built just five minutes from Bingin Beach. The land price in the area has soared from 14 million to 50 million IDR, adding an estimated $40,000 in capitalization to the project. With 195 tokens for your $5,000 stake, your share of that upside is around $780, plus $437 from the projected 8.75% ROI as of now.

- $5,000 in ROOTS Villa 1 in Ubud, Bali (under construction): Designed by award-winning architects and located in a high-demand wellness area of Ubud, this villa offers a construction ROI of 16.1%. Once completed, your $5,000 investment is projected to yield $805.

In the first year, your total return on the $20,000 investment would be $3,147, combining steady rental income with the potential for high gains from construction projects.

Start investing in real estate with just $500

You no longer need to save up thousands to get into real estate. With Binaryx, you can start investing with as little as $500.

You can create an account and browse through handpicked properties, like rental villas in Bali or apartments in Turkey. Each listing shows key details like location, rental income, and projected returns so you can choose what fits your goals.

For example, you could invest in a share of the Tropical Loft villa in Bali and start earning rental income without dealing with tenants or property maintenance.

New investment opportunities are added regularly, so there’s always something to explore—whether you're interested in residential rentals, commercial buildings, or mixed-use spaces.

If you're thinking about investing in real estate but have some concerns, you can always connect with the Binaryx team via hello@binaryx.com to ask any questions.

FAQs

Can you invest in real estate online?

Yes, you can invest in real estate online without owning physical property or dealing with tenants. Online platforms have made real estate investing accessible from your phone or laptop. With tools like tokenized assets and fractional ownership, you can start with as little as $500. These platforms often offer detailed investment overviews contained within their dashboards to help you make informed decisions. You can choose from a variety of real estate investment opportunities, from residential rentals to commercial buildings. Just be sure to read the respective offering materials and understand what you're investing in. Like all investments, online real estate carries some risks, but it’s never been easier to get started.

Can I invest $500 in real estate?

Absolutely — real estate investing is no longer limited to the wealthy. Many platforms now offer investment minimums as low as $500, letting you dip your toes in without a major commitment. This gives you the opportunity to diversify your investment portfolio gradually. You can earn dividend payments from rental income or profit if property values rise. These platforms often provide transparent data on returns, fees, and risks. Just remember, investing in real estate, even online, can involve substantial risks depending on market conditions. For beginners, it's a good idea to spread your $500 across different asset types or locations. Think of it as a low-barrier entry into a traditionally expensive asset class.

What is the 7% rule in real estate?

The so-called 7% rule isn’t a fixed formula — it’s more of a mindset used by savvy real estate investors. It refers to the top 7% of people who stay consistent, always learning, and committed to long-term results. These investors tend to see better outcomes, not because they time the market perfectly, but because they make smart, informed choices. In some circles, it’s connected to the idea that a 7% return is a good benchmark for real estate investments. However, returns can vary greatly depending on the real estate market and type of investment. Whether you're investing in a rental property or a REIT, the goal is steady growth and cash flow. Real estate investing isn’t about quick wins — it's about patience and strategy. That 7% rule is more about discipline than math.

Is $5,000 enough to invest in real estate?

Yes, $5,000 is more than enough to begin building a diversified investment portfolio in real estate. You can spread that amount across several platforms, each offering different types of real estate investments — from residential rentals to commercial spaces. Some platforms specialize in fractional ownership or tokenized property, letting you invest in multiple deals at once. This helps reduce risk while giving you access to various markets. Be aware, though, that all investments, including securities, involve risks, and real estate is no exception. With $5,000, you can take advantage of tax benefits tied to certain property types or structures, depending on your jurisdiction. It’s a solid starting point for generating cash flow and long-term wealth. Make sure to read the offering materials carefully and understand each platform’s management fees.

What is the best real estate investment for a beginner?

For beginners, the best entry point is usually platforms that offer fractional ownership or tokenized real estate. These let you invest small amounts while avoiding the complexity of managing tenants or dealing with repairs. You also don’t need to worry about the high housing costs associated with buying a full property. Some platforms provide a secondary trading platform, giving you flexibility to buy or sell your shares. This kind of investing fits nicely into a personal finance strategy focused on steady, passive income. Because you're only investing a small portion, it's easier to learn without taking on too much risk. The platforms often include detailed discussions contained in their resources to help you understand each deal. It's a low-risk way to start building your portfolio and gaining confidence in the real estate market.

Who should not invest in real estate?

Real estate investing isn’t for everyone. If you need instant access to your money or are uncomfortable with market volatility, you might want to reconsider. Unlike the stock market, real estate is less liquid, and it may take time to see returns. Some offerings may lock your funds for several years, so they’re not suitable for those needing short-term liquidity. If you're not willing to review principal business terms and understand each investment's risks, it's better to stay out. Also, if you’re not ready to read through applicable offering materials or consult a financial advisor, you could make costly mistakes. Some platforms require you to qualify for additional series offerings, which might not be available to everyone. In short, if you’re impatient or under-informed, real estate may not be the best fit.

What stops people from investing in real estate?

One big roadblock is the belief that you need a ton of money upfront. Many people don’t realize that platforms today allow investments starting from just $10. Another common fear is not knowing enough — which is valid, because real estate investments can involve complex terms and legal language. Also, concerns about managing properties or tenants keep many potential investors away. But modern platforms handle property management for you and provide relevant offering materials to guide decisions. Some people also fear market volatility or losing money due to unexpected shifts in property prices. Having access to a registered broker-dealer or investment advisor can ease these concerns. Thankfully, today’s tools have lowered the barrier to entry for millions of would-be investors.

What is the safest type of real estate investment?

Generally, residential rentals in affordable, stable neighborhoods are considered the safest form of real estate investment. These areas tend to have steady demand and reliable tenants, reducing vacancy risks. If you're focused on passive income, these properties can offer consistent cash flow with fewer surprises. Publicly traded REITs are another safe option, especially for investors looking for liquidity and lower investment minimums. They behave similarly to a mutual fund and can be bought and sold on the stock market. While no investment is completely without risk, these options typically don’t involve high property management costs or intense market speculation. Be sure to check the respective offering materials for dividend payments and past performance. Always balance safety with potential growth based on your own investment goals.

Articles you may be interested in

.png)

.png)

.jpeg)

.webp)