In-depth guide to blockchain real estate investment (2025)

Did you know that you can own part of a Miami apartment or a villa in Bali — all from your phone, starting with just $500?

Platforms like Binaryx make this possible by letting you invest in tokenized real estate and earn passive income. Recognized by EU-Startups as one of the most promising startups, Binaryx is changing how people own property using blockchain technology.

How exactly do such real estate transactions work?

Real estate is divided into small digital pieces called "tokens." Each token represents a part of the property. When you invest, you own a portion of the property through these tokens.

And this isn't just a short-term trend. It’s growing fast and becoming more popular every year. According to Worldmetrics, the global market for real estate tokenization is expected to reach $4.22 billion by 2027.

Traditionally, investing in real estate properties required significant money and a lot of paperwork. But blockchain is changing this by simplifying the process and making it more affordable.

In this article, we’ll explore all the ins and outs of blockchain real estate investment so you can make a well-informed choice. We’ll take a closer look at how it works, how it differs from traditional approaches, the top platforms, regulatory implications, potential risks, and current trends.

What is blockchain real estate investment?

Blockchain real estate investment allows you to own a portion of a property without purchasing it entirely. Instead of buying a whole property, you can own a fraction of it by investing in digital tokens. These tokens represent part of the property’s value.

Blockchain turns a physical property into digital tokens. These tokens can represent fractional ownership in a property and can be bought, sold, or traded on specialized platforms like Binaryx.

One example is an apartment in Hayat Green Tower in Alanya that’s divided into small, tradable tokens. If you invest in it, you’ll own a fraction of that apartment and earn a share of the rental income or any profits from selling the property later.

With blockchain technology, you don’t need to purchase the entire apartment or house. You can simply buy tokens that represent part of these high value properties.

This is different from traditional real estate property ownership, where you need a large amount of money upfront, plus time-consuming paperwork and many middlemen. With blockchain, the process is faster and more affordable. It uses smart contracts, which automatically handle property transactions.

Key benefits of using blockchain technology for real estate investment

Thanks to real estate tokenization, investors no longer need millions to enter the market.

1) Fractional ownership

Blockchain technology enables more investors to purchase portions of properties. It helps to lower entry barriers by letting people invest small amounts instead of needing thousands to buy a whole property.

Each investor owns a fraction, and profits (like rental income) are shared based on the size of that share.

2) Enhanced liquidity

Tokenized assets can be traded on secondary markets, providing more flexibility compared to traditional real estate investments.

This disrupts the traditional model by facilitating continuous trading that operates 24/7, allowing investors to respond to real-time market shifts

3) Transparency

One of the biggest perks of blockchain in real estate is its transparency. Every transaction is recorded on a public ledger, accessible to everyone involved. This reduces the chance of errors or fraud, as every change in ownership is permanently recorded. With real-time data and transparent transaction history, blockchain empowers investors to make more informed decisions about where and when to invest.

Take Propy, for example. This blockchain-based platform made headlines in 2017 by facilitating one of the first blockchain real estate sales, where an apartment in Kyiv was sold through Ethereum’s blockchain. The transaction was fully transparent, accessible to all parties, and free from disputes.

4) Reduced intermediaries

Smart contracts automate processes, potentially lowering transaction costs and increasing efficiency.

This cuts intermediary costs that usually make up 5-6% of property values, and smart contracts automate processes to improve efficiency.

5) Efficiency in processes

Blockchain technology automates many real estate investing tasks, such as ownership verification, payment processing, and deed recording. This automation drastically reduces the time and costs involved in property ownership deals.

For example, Sweden’s Land Registry tested blockchain to digitize property registration. What used to take months was cut down to a few days.

6) Reduced risk of fraud

Blockchain’s decentralized structure enables secure data sharing. Since all transactions are recorded on an unchangeable ledger, fraud becomes almost impossible. Every transaction stored on the blockchain creates an immutable record, reducing the risk of fraud and disputes in the property transfer process.

Dubai has always pioneered emerging trends, and blockchain is no exception. Dubai’s Land Department has embraced blockchain to fight real estate fraud and ensure data security. With property ownership records stored on a blockchain, DLD ensures these records can’t be tampered with.

Best blockchain real estate platforms in 2025

If you're looking to invest in property through blockchain technology, here are some of the top platforms leading the space:

1) Binaryx

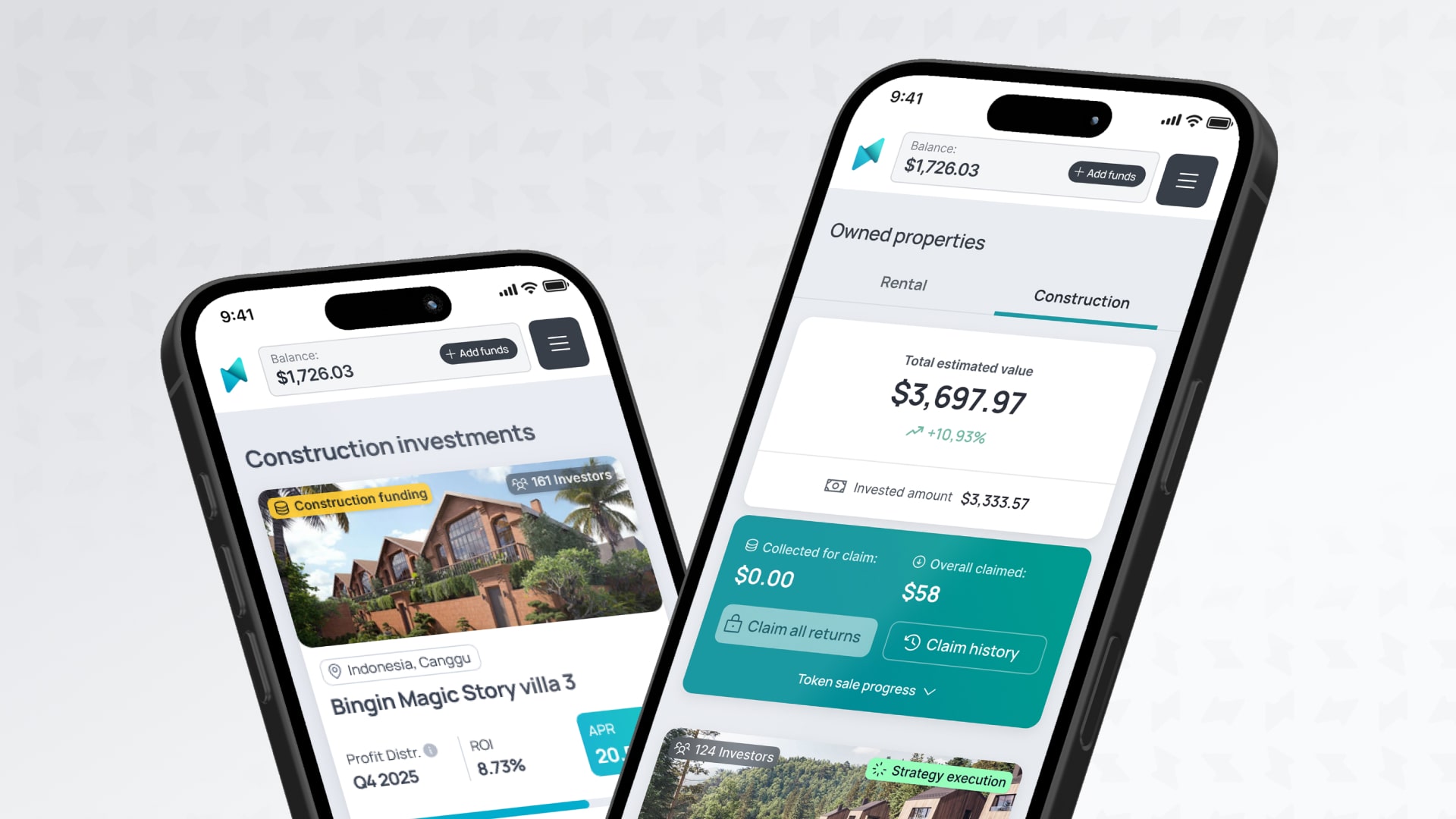

Binaryx lets investors get started with as little as $500. All properties are listed on the marketplace, and investors can purchase them in fractions. You can invest every month in high-yield real estate and earn up to 16.3% annual rental return. Also, you can sell your fractions on the secondary market with just a few clicks and easily retrieve your investments. Binaryx unites a community of over 70,000 members across X (Twitter), Discord, YouTube, Telegram, and Medium. It brings together both beginners and experienced investors, offering helpful resources and support.

2) RealT

RealT offers fractional ownership of U.S. rental properties. Investors earn daily rental income via blockchain-based tokens.

3) DigiShares

DigiShares provides white-label solutions for compliant real estate tokenization. Ideal for property developers and asset managers.

4) Propy

Propy allows buyers to complete real estate transactions online using smart contracts, streamlining paperwork and increasing transparency.

5) BitProperty

BitProperty platform aims to enable global users to invest in income-generating properties using crypto assets. It offers a real estate tokenization platform on the Ethereum blockchain, allowing investors to create, buy, or sell rights to real estate revenue streams with a new kind of asset class.

6) Growie

Growie focuses on Latin American investors, providing access to U.S. real estate through blockchain-based participation. It offers an easy, secure way to invest in U.S. real estate from anywhere, starting with just $1,000, and emphasizes transparency, low fees, and premium U.S. real estate projects.

7) ETFRIX LTD

ETFRIX LTD blends traditional finance with blockchain technology, offering tokenized real estate and diversified crypto ETFs. It provides a real estate tokenization platform, allowing investors to access premium real estate assets through blockchain-based tokens.

Comparison of traditional and tokenized real estate investment approaches

Real estate has long been considered one of the most stable and lucrative investments available, providing steady returns for investors through property ownership, rental income, and appreciation. And with the advent of blockchain technology, a new method of owning, managing, and trading real estate assets has emerged.

Traditional real estate is known for slow transactions, but blockchain technology streamlines every step, from offer to ownership. Let’s compare the traditional approach to real estate investment with the growing trend of tokenized real estate.

1) Traditional real estate investment

Traditional real estate investment involves the purchase of physical property, which may include residential, commercial, or industrial properties. This method typically requires a significant upfront capital investment, as well as ongoing management and maintenance.

Investors in traditional real estate often rely on financing, such as mortgages or loans, to acquire property. Ownership is recorded on paper, through titles and deeds, and the transfer of ownership typically requires legal processes such as notary services and government documentation.

While traditional real estate offers significant long-term gains and stability, it comes with various challenges. The high cost of entry, illiquidity, and ongoing management requirements can deter many from participating in the market.

Also, transactions and ownership transfer often involve third parties, such as banks, real estate agents, and legal professionals, making the process time-consuming and expensive.

2) Tokenized real estate investment

Tokenized real estate, on the other hand, leverages blockchain technology to divide ownership of a property into digital tokens. Each token represents a share of the property, which can be bought, sold, or traded on a blockchain platform.

By breaking down a property into smaller digital tokens, investors can purchase only what they can afford, and they no longer need to manage properties themselves.

Tokenization makes it easier for investors to buy fractional shares in properties, significantly lowering the barrier to entry.

The use of blockchain ensures the security and immutability of transactions, while smart contracts automate the process of buying, selling, and transferring ownership, reducing the need for intermediaries.

Regulatory implications of blockchain in real estate

The traditional real estate industry has been heavily regulated, with a lot of paperwork and legal checks. Laws are set by governments to ensure fair practices, support data security, protect investors, and maintain transparency of real estate transactions.

And how does blockchain fit into the real estate sector?

Because real estate deals via blockchain is still a relatively new approach, governments around the world are figuring out how to regulate it. Different countries have varying approaches to blockchain regulations, and it’s important for investors to know how these rules affect their investments. Let’s look at a few examples:

- United States: The Securities and Exchange Commission (SEC) is looking closely at how blockchain real estate investing works. The SEC wants to ensure that tokenized real estate complies with securities laws designed to protect investors.

- European Union: The European Union has a more unified approach, with regulations that focus on creating a Digital Single Market. They are working on setting rules for digital assets, including tokenized real estate.

- Singapore: Singapore is one of the leaders in blockchain adoption. The country has set up clear regulations that allow blockchain-based platforms to operate smoothly. The Monetary Authority of Singapore (MAS) provides guidelines on how digital tokens and real estate deals should be treated.

If you’re thinking about blockchain property investment, make sure you understand the laws in your country or region before making transactions. Blockchain real estate regulations can vary greatly from one place to another. You’ll need to keep an eye on updates and be prepared to adjust your investment strategy as new laws are passed.

It is important to choose blockchain real estate platforms that follow all the necessary regulations. Binaryx and others are working with regulators to ensure they operate legally and securely.

Considerations and risks of investing in real estate assets with blockchain

While blockchain offers numerous advantages in real estate investment, potential investors should be aware of certain risks:

Regulatory uncertainty

The legal framework surrounding real estate tokenization is still evolving, which may affect the stability and legality of investments.

Market volatility

The value of tokenized assets can fluctuate, influenced by market conditions and investor sentiment.

Operational challenges

Issues such as property management and maintenance remain critical. For instance, RealT's recent challenges in Detroit highlight the importance of effective property management.

Top trends in blockchain and real estate in 2025

Blockchain is changing the real estate game by increasing transparency, cutting costs, and opening the market to a broader range of investors. Here’s what’s happening in the tokenized real estate sector right now:

1) Tokenization is becoming more sophisticated

Tokenization (the process of turning real estate into digital assets) is no longer just about splitting properties into small pieces. Today, tokenization platforms offer better security, easier trading, and smarter contracts that can automatically handle things like rent payments and ownership transfers.

2) Real estate-backed NFTs

Some platforms are starting to use NFTs (non-fungible tokens) to represent real estate. Unlike regular tokens, each NFT is unique and can represent a specific property or unit. This means you could one day buy a condo or office space as a unique digital asset (an NFT) that proves you’re the owner, all stored safely on the blockchain.

3) Integration of smart contracts

Smart contracts are self-executing contracts with the terms directly written into code. In real estate, they automate processes like property transfers, lease agreements, and payments, reducing the need for intermediaries and minimizing errors.

4) Adoption of cryptocurrency payments

Cryptocurrencies, especially stablecoins like USDC, are increasingly used for real estate transactions due to their speed and lower fees. This is particularly beneficial for international deals.

5) Enhanced transparency and security

Blockchain technology is being utilized to create tamper-proof records of property ownership and transaction history.

6) Emergence of digital twins

Digital twins are virtual replicas of physical properties, enabling real-time monitoring and management. They assist in predictive maintenance and energy efficiency. By 2030, it's expected that 70% of large cities will use digital twins.

7) Artificial Intelligence (AI) and Machine Learning (ML) in real estate

AI can analyze huge amounts of data to help investors predict property values, rental income, or maintenance needs. ML models can help spot fraud, assess risk, or suggest the best times to buy or sell, making investment decisions more accurate.

8) Smart Homes and Internet of Things (IoT) devices

Smart homes are packed with devices that connect to the internet, like smart thermostats, locks, and cameras. In real estate, this means buildings can be more efficient, secure, and appealing to renters and buyers. Investors also benefit from better data on how properties are used and maintained.

9) Virtual Reality (VR) and Augmented Reality (AR) for property tours

With VR and AR, you can now tour a home or building without ever stepping inside. Virtual tours let buyers and investors explore properties from anywhere in the world. This tech helps speed up decisions and makes international real estate investing easier.

10) Digital Transaction Management (DTM)

Digital transaction tools make it possible to handle everything — signatures, contracts, and payments — online. This eliminates the need for physical paperwork and reduces delays. Combined with blockchain, DTM ensures that every step of the transaction is secure and transparent.

11) Increased institutional participation

Institutional investors are showing growing interest in blockchain-based real estate investments, recognizing the potential for diversification and improved liquidity. Major asset managers like BlackRock and Fidelity are exploring the tokenization of funds to enhance asset transfer efficiency.

12) Focus on sustainability

Blockchain is being leveraged to track and verify sustainable practices in real estate, appealing to environmentally conscious investors. Projects are emphasizing the use of blockchain to authenticate green building certifications and sustainable operations.

Start investing in real estate with just $500

You don’t need thousands of dollars to start investing in real estate anymore. With Binaryx, you can get started with as little as $500. It’s a simple way to grow your money by owning small parts of real properties.

You can create an account, explore a curated selection of ready-to-rent properties, and review details like location, rental income potential, and expected returns. Once you find a match, you can invest in a fraction of the property.

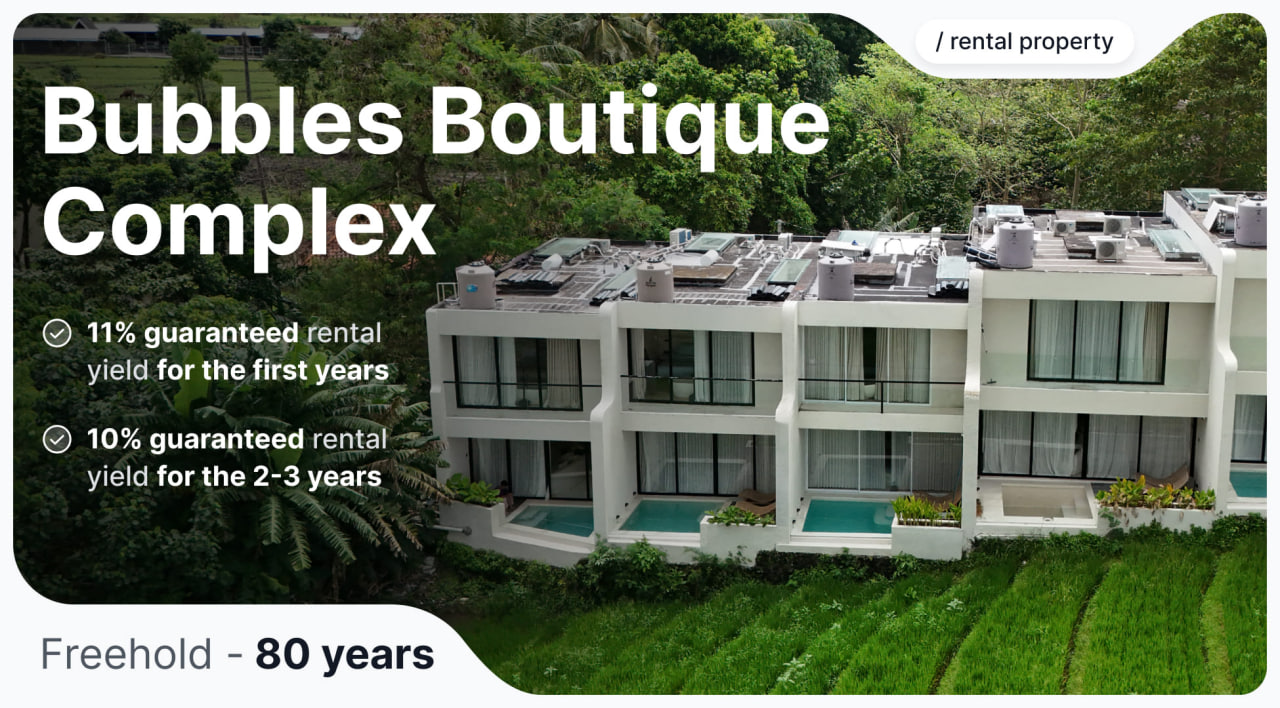

For example, one opportunity is the Tropical Loft villa in Bali.

Many new properties are added regularly to this marketplace, so there are always fresh opportunities to explore.

Whether you’re eyeing residential units, commercial real estate spaces, or mixed-use developments, real estate can be a great way to grow your wealth. Especially when backed by the right platform.

If you're thinking about investing in real estate but have some concerns, you can always connect with the Binaryx team via hello@binaryx.com to ask any questions.

FAQs

Is blockchain used in real estate?

Yes, blockchain technology is actively transforming the real estate industry by streamlining real estate transactions and reducing reliance on intermediaries. Through smart contracts, blockchain platforms automate key steps like property transfers, rent payments, and ownership verification, improving operational efficiency and security. Real estate assets are also being tokenized into digital assets, making it easier for property owners and investors to trade real estate on secondary markets. As a result, blockchain in real estate is helping to modernize the real estate sector and attract a broader audience of global investors.

Are blockchains a good investment?

Blockchain real estate is gaining popularity as an investment vehicle due to its ability to tokenize real-world assets and enable fractional ownership of commercial real estate. This provides investors with greater liquidity, faster access to cash flows, and reduced costs compared to traditional property transactions. Blockchain platforms offer immutable record-keeping, secure data sharing, and improved transparency in transaction history, making it easier for investors to make informed decisions. While the future outlook is promising, it’s essential to research the real estate market and choose reputable blockchain real estate companies.

What is a smart contract for real estate using blockchain?

A smart contract is a self-executing code stored on a blockchain platform that automates real estate transactions like rent payments, lease enforcement, and property transfers. In the real estate sector, smart contracts reduce slow transactions, eliminate paperwork, and minimize human error in asset management and property development. These contracts increase operational efficiency by ensuring terms are fulfilled exactly as programmed, without needing intermediaries. For real estate professionals and investors, smart contracts offer a reliable, secure, and transparent way to manage property transactions.

Can I invest in real estate with crypto?

Yes, cryptocurrency is becoming a popular method for investing in the real estate market, especially on blockchain real estate platforms that support digital asset transactions. By using crypto, investors can buy fractional shares of tokenized commercial real estate and gain exposure to various industries without dealing with traditional financial barriers or credit history checks. Blockchain in real estate allows for faster, cross-border transactions and reduces costs associated with bank transfers and legal fees. This opens up more investment opportunities for a broader audience and simplifies the real estate process for property owners.

How does blockchain increase transparency in the real estate industry?

Blockchain creates an immutable ledger that securely records every stage of real estate transactions, from property development to final sale. This transparent transaction history builds trust between investors, property owners, and real estate professionals while helping prevent fraud. Blockchain platforms also allow for secure data sharing, making it easier to verify ownership, track cash flows, and manage property assets. In turn, this transparency improves asset management practices and strengthens the integrity of the entire real estate sector.

What types of real estate can be tokenized?

Virtually all types of real estate assets—including residential homes, office buildings, and commercial real estate—can be tokenized using blockchain technology. Tokenization transforms these assets into digital assets that can be easily traded on online marketplaces or secondary markets. This helps real estate companies raise capital efficiently and enables investors to access the real estate market without needing to purchase entire properties. Tokenized assets also facilitate more liquid property transactions and make it easier to diversify portfolios across different real-world assets.

What are the risks of investing in blockchain real estate?

Despite its benefits, investing in blockchain real estate involves risks such as market volatility, evolving regulations, and limited oversight in certain jurisdictions. The real estate industry is still adjusting to blockchain-based property transactions, and not all countries legally recognize ownership recorded via smart contracts. Additionally, some blockchain platforms may lack transparency or have technical flaws, impacting transaction data and cash flows. It's crucial for investors to do their due diligence, use platforms with secure data sharing, and assess the long-term viability of their investment opportunities.

How is blockchain making it easier to start owning real estate?

Blockchain in real estate is lowering barriers to entry by enabling ownership of tokenized real estate assets through online marketplaces. These platforms allow people to invest in fractional shares of properties, offering a more accessible path to owning real estate without large upfront capital. Blockchain also increases security by recording all transactions on an immutable ledger and reduces costs by cutting out middlemen and streamlining property transfers. This leads to significant cost savings for both investors and property owners while improving transparency and trust in the real estate process.

How is blockchain improving property management?

Blockchain technology is revolutionizing the real estate industry and property management by automating routine tasks such as rent payments, maintenance requests, and lease tracking through smart contracts. This boosts operational efficiency, reduces costs, and ensures transparent cash flows for property owners and asset managers. Property management teams also benefit from immutable records of property transactions and tenant interactions, improving service quality and compliance. In the future outlook, blockchain-enabled property management systems will play a major role in enhancing the performance of the real estate sector.

-min.jpg)