In 2023, real estate made up nearly 40% of global assets, totaling over $379 trillion. But only a tiny fraction — around $3.5 billion — has been tokenized.

That’s less than 0.001% of the market.

The opportunity? Massive. The transformation? Already underway.

Tokenized real estate is no longer an experiment—it’s becoming a smarter, more flexible way to invest in one of the world’s oldest asset classes.

Let’s take a closer look at how tokenized real estate stacks up against traditional real estate investment — and why more people are starting to make the switch.

A quick detour: What’s RWA?

In crypto, RWA means real-world assets. These are physical assets—like real estate, gold, or art—that are represented on the blockchain. The idea is simple: bring these assets into the digital world to make them easier to buy, sell, or trade.

Tokenized RWAs are projected to become one of the fastest-growing sectors in crypto. In early 2024, 21.co projected that RWA tokenization could unlock $10 trillion by 2030. Meanwhile, Boston Consulting Group put the number even higher—up to $16 trillion.

And real estate is expected to be the leading use case.

“Tokenization is not a question of if, but when. And it’s already happening faster than most people realize.”

— Larry Fink, CEO of BlackRock, speaking on cryptocurrencies

Curious to learn more about how tokenized real-world assets are reshaping global finance?

Download our exclusive report “RWA Thesis 2025: On the Verge of Growth and Mass Adoption” and stay ahead of 99% of investors.

Now that we understand the broader concept of real-world assets, let’s zoom in on its most promising category — real estate.

What is tokenized real estate?

.png)

Tokenized real estate refers to the process of converting ownership of a physical property into digital tokens on a blockchain.

Each token represents fractional ownership of the property—allowing anyone to invest without needing to buy the whole building.

Here’s how it works:

- A legal entity (often an SPV) owns the property.

- Ownership is divided into blockchain-based tokens.

- Investors buy tokens and earn a share of rental income or capital gains.

You’re not just buying a digital token—you’re buying a legally backed share of a real asset.

To grasp the scale of this shift, let’s look at how tokenized real estate stacks up against the traditional market.

Market snapshot: traditional vs tokenized real estate

Even though tokenized real estate is still a tiny fraction of the market, momentum is building fast, and projections suggest it could reshape how we invest in property over the next decade.

Market Size (2024)

- Traditional Global Real Estate - $379 trillion (Savills)

- Tokenized Real Estate - $3.5 billion (Fortune BI)

- Projected Tokenized Real Estate (2030) - $3 trillion (Business Wire)

- Projected RWA tokenized market (2030) - $30 trillion (Security Token Market)

These numbers might seem small for now, but the pace of adoption tells a different story.

The tipping point: adoption in motion

Tokenization is no longer theoretical. Institutions are already using it:

- JPMorgan completed its first tokenized collateral settlement on Onyx blockchain in 2023.

- HSBC launched tokenized gold and began testing tokenized real estate lending in 2024.

- BrickMark, based in Switzerland, tokenized over $135 million of commercial property on Ethereum.

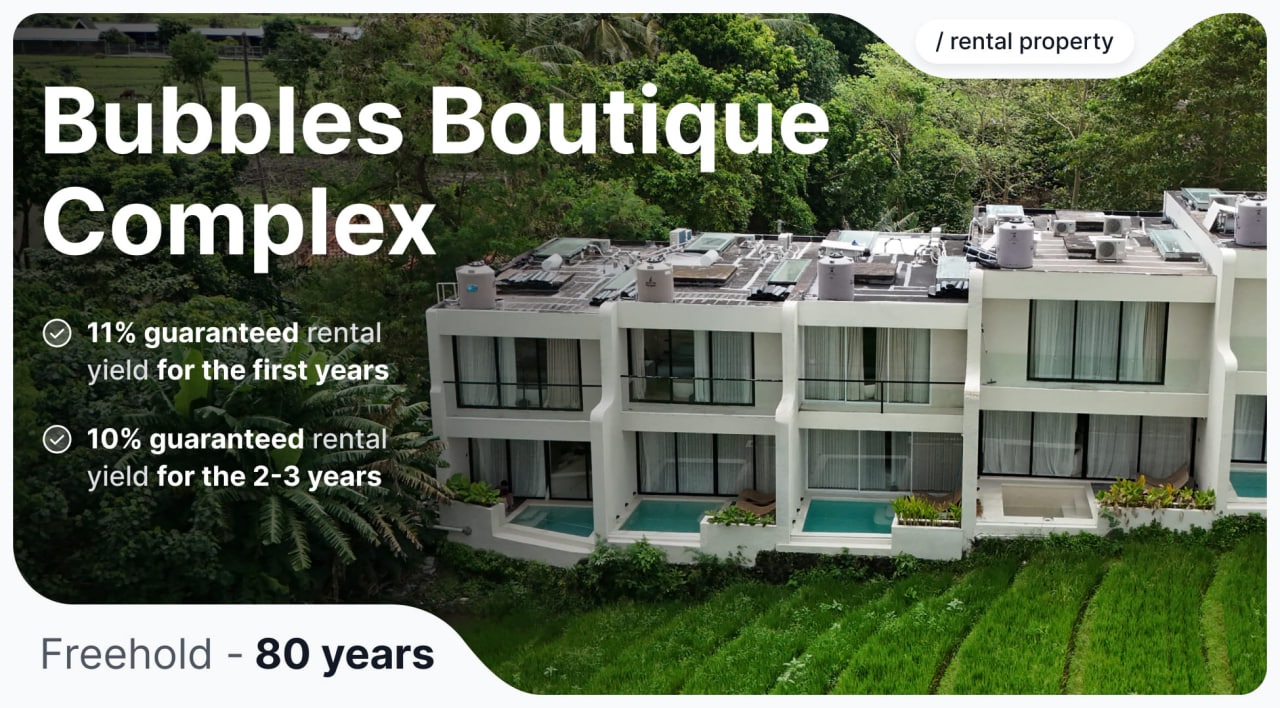

On the retail side, platforms like Binaryx, RealT, and Lofty are bringing real estate investment to everyday users, starting from as little as $500.

“Imagine unlocking the real estate market for millions who were previously priced out. That’s the promise of tokenization.”

— Carlos Domingo, CEO of Securitize, the world leading company in tokenizing real-world assets

If you are still not convinced that tokenized real estate is slowly but surely taking over the traditional heavy industry, here’s more…

Tokenized vs Traditional Real Estate: A direct comparison

Clearly, tokenization opens new doors—lower barriers, more liquidity, and a global playing field. For many investors, it’s not about replacing traditional real estate—it’s about unlocking access to it.

Why more investors are switching

Diversification made easy

Instead of buying one property, you can spread $10,000 across multiple tokenized real estate assets worldwide — like a villa in Bali, an apartment in Dubai, and a studio in Prague.

Passive income, no hassle

No tenants. No maintenance. Most tokenized properties are professionally managed, and income is distributed directly to your wallet.

Faster liquidity

You can often exit your position in days, not months, thanks to integrated marketplaces or peer-to-peer transfers.

Transparent reporting

Smart contracts automate ownership and payouts. Blockchain records every transaction. No middlemen needed to verify.

And it’s not just theory—tokenized real estate is already delivering results in the real world.

Not just hype: real use cases with real money

Real estate tokenization has transitioned from concept to reality, with several high-profile projects demonstrating its potential:

Tokenization of a Multifamily Apartment Complex in Dallas, USA

.png)

- Project: A 250-unit multifamily apartment complex in Dallas, Texas

- Details: A 250-unit multifamily apartment complex raised $6.5 million via tokenized offerings, allowing fractional investment in a $47 million development. This opened the door for smaller investors to access large-scale U.S. residential projects, with secondary trading adding liquidity.

Tokenization of Dubai Real Estate by MAG Group and MANTRA Chain

.jpeg)

- Project: Tokenization of $500 million worth of real estate in Dubai

- Tokenization Details: MAG Group partnered with MANTRA Chain to tokenize $500 million worth of real estate. As one of the most considerable tokenization moves in the Middle East, it signals growing regional interest in using blockchain to democratize access to premium real estate assets.

Tokenization of a Residential Building in Baar, Switzerland by Blockimmo

.png)

- Project: A residential building in Baar, Switzerland

- Tokenization Details: Swiss platform Blockimmo tokenized a residential building, enabling everyday investors to buy digital shares in the property. The project reflects Europe’s early momentum in simplifying cross-border real estate investment through blockchain.

A note on the risks

But just like any investment, tokenized real estate has its risks, and it’s essential to be aware of them before jumping in.

- Regulations are still evolving in many jurisdictions.

- Liquidity depends on the marketplace you use.

- Ownership structures must be legally sound.

- Returns depend on real-world property performance.

How the Binaryx platform mitigates these risks:

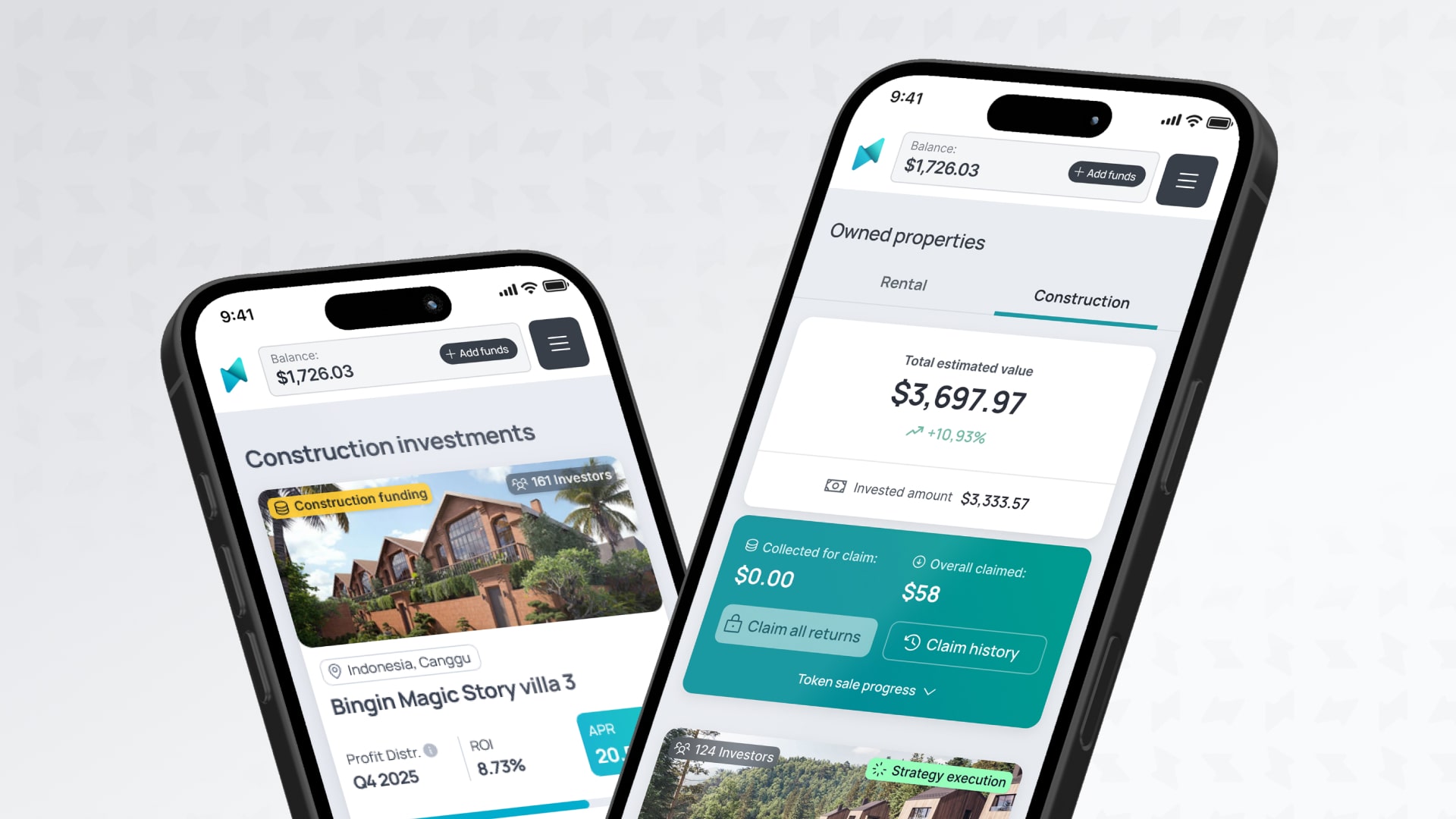

At the Binaryx platform, we’re fully aware of these challenges, and we’ve designed our platform to reduce them for investors:

- Local market intelligence: We work with dedicated teams of local experts who continuously monitor demand trends and analyze each market.

- Professional property management: All assets are managed by experienced operators who handle rentals, maintenance, and customer service end-to-end.

- Strict due diligence: Every property and developer undergoes a thorough 30+ point inspection to avoid risky or underperforming investments.

- Trusted developers only: We partner exclusively with developers with a strong track record and a reputation for delivering high-quality projects.

- Legal protection: Investments are structured under U.S. law, offering strong investor protection and legal clarity.

- Simple online process: Buying into real estate is as easy as shopping online—choose a verified property and buy a fraction in just a few clicks.

This way, the Binaryx platform combines the flexibility of tokenization with the real-world due diligence and legal protection that modern investors expect.

Final thoughts

Traditional real estate remains a cornerstone of wealth. But tokenization is making it more inclusive, liquid, and aligned with how modern investors think.

At Binaryx platform, you can start global real estate investing with just $500 — there are no brokers, no paperwork, just verified assets and complete transparency.

So the question is: are you still waiting to buy a home, or ready to own part of ten?

Articles you may be interested in

.jpeg)

.jpeg)

-min.jpeg)

.webp)