8 Best Countries to Invest in Real Estate in 2026 (Data-Backed Analysis)

Executive Summary: The 2026 Market Shift

The global real estate market is pivoting. After years of high interest rates and caution, 2026 is forecast to be a year of recovery and aggressive growth. According to Savills Research, global real estate investment turnover is expected to surpass $1 trillion in 2026 for the first time since 2022.

Why now? Central banks in Europe and North America have entered rate-cutting cycles, acting as a major catalyst for recovery. Furthermore, 62% of institutional investors expect to be net buyers this year.

For individual investors, the window to enter high-growth markets before institutional capital fully saturates them is opening. This guide ranks the top 8 countries based on capital appreciation, rental yields, and stability.

Important Note for Investors: While many countries listed below offer residency or "Golden Visa" benefits for full property ownership (often requiring $200k–$500k+), this guide also highlights how to access the financial returns of these lucrative markets through tokenized investing—starting with as little as $500—without the need for expensive visas or travel.

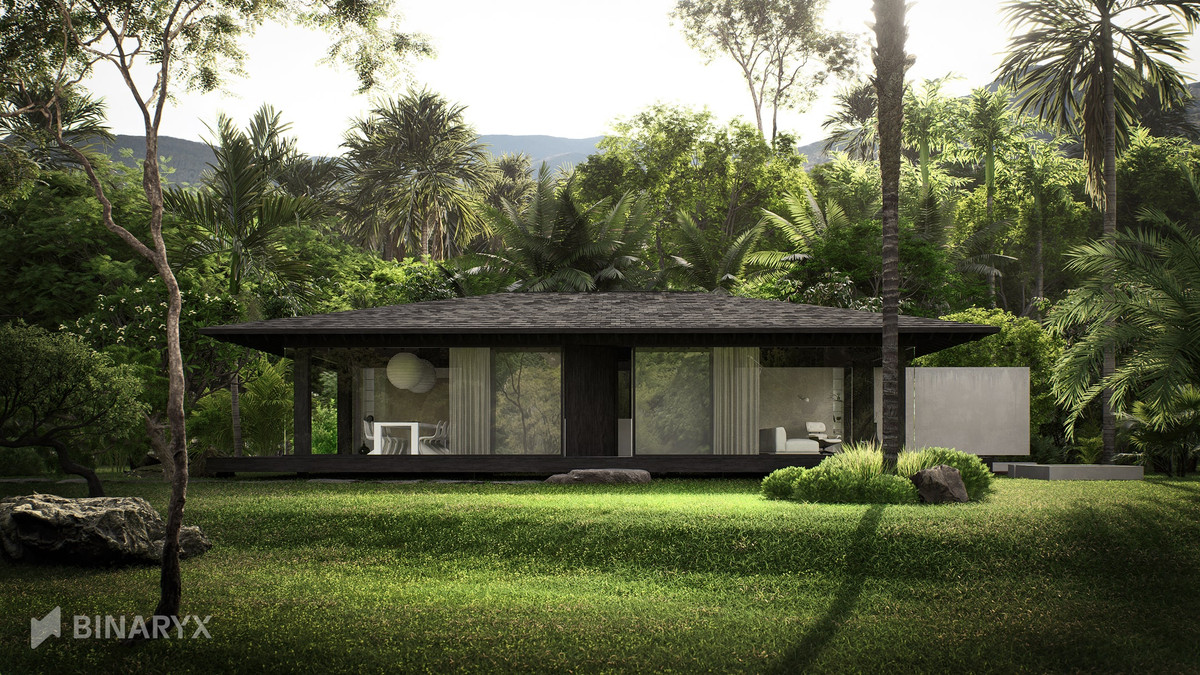

1. Indonesia (Bali)

Best For: High rental yields and tourism-driven returns.

Bali has evolved from a tropical holiday destination into a globally recognized investment hub. It stands out as the highest-yielding sub-market in Southeast Asia, with luxury properties in prime zones reaching 20% gross yields.

- Projected Yields: 6–8% for standard villas; up to 12% for luxury assets.

- Entry Price (Physical): ~$3,400 per sqm for apartments.

- Growth Driver: Tourism arrivals exceeded 6 million in 2024, and new infrastructure like the Gilimanuk-Mengwi toll road is opening new investment corridors.

Why it matters for Binaryx investors: Bali is a prime example of a high-barrier market. Foreigners cannot hold freehold titles directly, and navigating leasehold structures is complex. Tokenization solves this: you get exposure to these 8-11% yields without managing a villa, dealing with local tax compliance, or flying to Indonesia to sign papers.

2. United Arab Emirates (Dubai & Abu Dhabi)

Best For: Tax-free income and high liquidity.

Dubai enters 2026 as the world's most active residential market, having recorded over 205,000 transactions in 2025. The transition from a speculative market to one driven by genuine end-user demand has stabilized the region.

- Projected Yields: 6.55% (Dubai) to 6.32% (Abu Dhabi).

- Capital Growth: Prices rose approx. 60% between 2022-2025.

- Key Advantage: 0% property tax and a Golden Visa program offering 10-year residency for substantial investors.

Investor Note: Supply is rising, with 100,000 new units forecast for 2026. However, rapid population growth (4M+ residents) is keeping absorption rates healthy.

3. Portugal

Best For: Stability and European exposure.

Portugal remains a top performer in Europe. Knight Frank ranks Lisbon among the top 4 cities globally for 2026. Despite global uncertainty, Portuguese house prices surged 48% over the last five years.

- Projected Yields: 5.2% (Lisbon) to 6.6% (Porto).

- Capital Growth: +16.9% year-over-year price growth in Q1 2025.

- Key Advantage: The Golden Visa program continues to offer a path to EU residency, attracting significant foreign capital.

4. Saudi Arabia

Best For: Massive infrastructure growth (Vision 2030).

Saudi Arabia is arguably the fastest-transforming market on this list. With a new foreign ownership law effective January 2026, the market is opening up significantly.

- Projected Yields: 8.89% in Riyadh.

- Capital Growth: Riyadh apartment prices have climbed 75% in the last 5 years.

- Catalyst: Trillions in spending on "Giga-projects" like NEOM and The Red Sea.

5. Spain

Best For: Lifestyle and moderate growth.

Spain is leading the Southern European rebound. With 10.4% national price growth in 2025, it is outperforming many northern European neighbors.

- Projected Yields: 4-6% gross yield.

- Key Advantage: The "Beckham Law" provides tax incentives for foreign professionals, and tourism remains at record highs.

6. Turkey

Best For: Value seeking (High Risk/High Reward).

Turkey is a complex market. It ranked #1 globally for price growth for two consecutive years (32.2% nominal growth), but high inflation eats into real returns.

- Entry Point: Very low, approx. $1,500 per sqm in cities.

- Citizenship: Investment of $400,000 grants citizenship.

- Risk: Currency volatility is a major factor here.

7. Japan (Tokyo)

Best For: Capital appreciation and safety.

Tokyo is currently the world's strongest prime residential market, seeing an extraordinary 55.9% annual price growth in Q3 2025.

- Market Dynamic: Unlike the rest of the world, Japan is seeing rising interest rates, yet demand remains heavily supply-constrained.

- Growth: 120% prime price growth over 5 years.

8. India

Best For: Long-term volume and demographic growth.

India is powered by a massive demographic dividend. Bengaluru ranked 3rd globally for prime growth (9.2%) in late 2025.

- Growth Outlook: IMF forecasts ~6.5% GDP growth, one of the fastest globally.

- Sector Focus: Strong office leasing demand driven by the tech sector.

The Barrier: Why Most Don't Invest Globally

While the data above is compelling, the traditional barriers are high:

- High Capital: Buying a property in Dubai or Portugal often requires $200k–$500k minimum.

- Legal Headaches: Navigating foreign ownership laws (like Indonesia's leasehold structures or Saudi's new regulations) is complex and costly.

- Liquidity: Selling a physical house in Spain or Turkey can take months.

The Solution: Real Estate on the Blockchain

Technology has solved the accessibility problem. Platforms like Binaryx allow you to invest in high-yield real estate markets (like Bali) without buying the whole building.

- Fractional Ownership: Start with as little as $500.

- Hassle-Free: Property management, tenant sourcing, and legal compliance are handled by the platform. You just collect the yield.

- Liquidity: Sell your fractions on the secondary market whenever you want, avoiding the months-long process of selling physical property.

Risk & Transparency

Investing in real estate—whether physical or tokenized—carries risks.

- Market Risk: Property values can fluctuate based on local economic conditions (e.g., Turkey's inflation or Dubai's supply cycles).

- Currency Risk: If you invest in assets denominated in foreign currency (like IDR or TRY), exchange rates will impact your returns relative to USD.

- Liquidity: While tokenized assets are more liquid than physical houses, secondary market volume varies.

- Visa Clarification: Tokenized investing provides financial exposure to these markets. It does not typically qualify you for government "Golden Visa" or citizenship programs, which usually require direct, deeded ownership of high-value assets.

Conclusion: Your Next Step

The 2026 outlook is bullish, with $1 trillion in global volume expected. Whether you are looking for the stability of Tokyo or the high yields of Bali, the opportunity cost of waiting is rising.

You don't need $500,000 or a plane ticket to start. You just need to choose the right market.

Ready to build your global portfolio?

Join thousands of investors accessing high-yield real estate on the blockchain.

Explore High-Yield Properties on Binaryx

FAQ

Q: Which country has the highest real estate ROI in 2026?

A: For pure rental yield, Indonesia (Bali) leads with 8-15% yields. For capital appreciation, Japan (Tokyo) saw 55.9% growth recently, though past performance is not a guarantee of future results.

Q: Can foreigners buy property in Saudi Arabia?

A: Yes. A new foreign ownership law effective January 2026 allows non-Saudis to purchase residential property in defined areas.

Q: Is investing in Dubai tax-free?

A: Yes. The UAE currently has a zero property tax and zero capital gains tax regime for individuals.

Articles you may be interested in

.png)

.png)

.jpeg)

.webp)