Binaryx Tax Guide 2025: Real Estate Tokenization Taxes for Global Investors

Binaryx Tax Guide 2026: Real Estate Tokenization Taxes for Global Investors

Investing in tokenized real estate is revolutionary. Dealing with the taxes? That often feels like the same old headache.

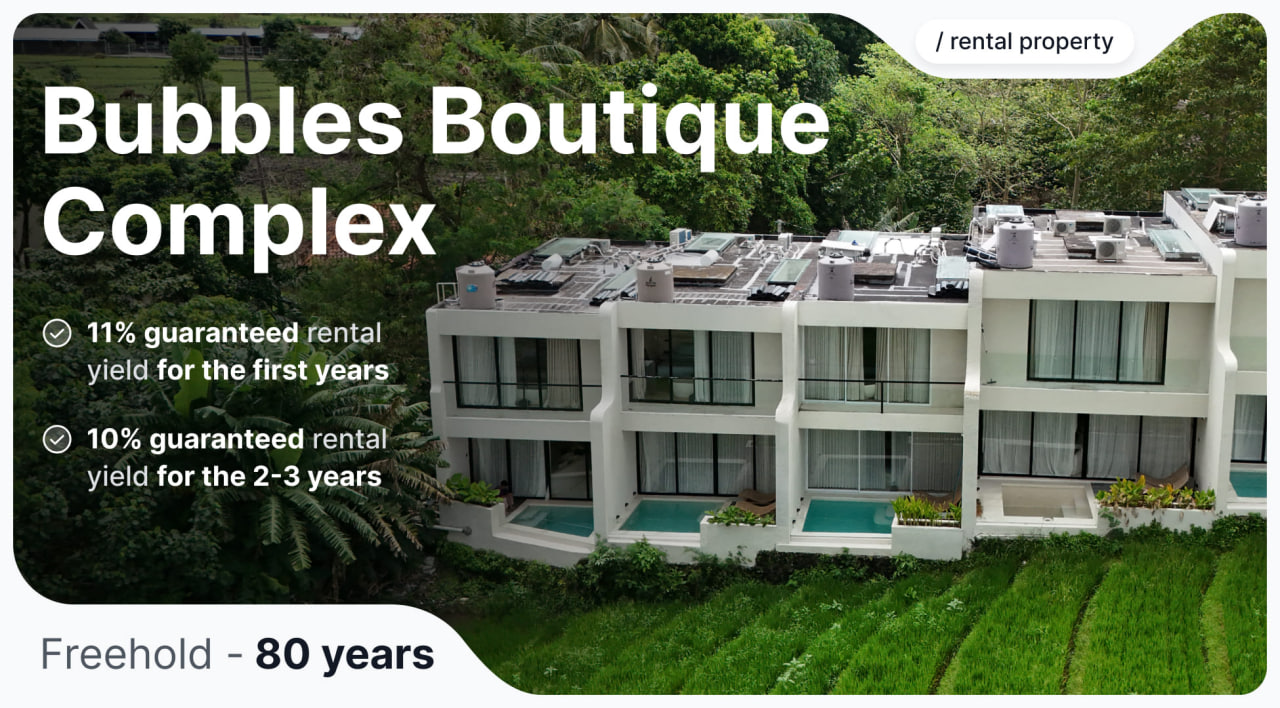

If you are investing through Binaryx, you are buying into a US Wyoming LLC. While this structure is incredibly efficient for property management, it creates unique tax scenarios depending on where you call "home."

Whether you’re an expat in Bali, a resident of Berlin, or an investor in Toronto, this guide breaks down exactly what the US LLC structure means for your tax bill—with real-world numbers to back it up.

The Core: How the US Structure Works

Before we look at your local taxes, you need to understand the source.

When you buy tokens on Binaryx, you aren't just buying "crypto"; you are buying a legitimate ownership share in a US Limited Liability Company (LLC).

The "Pass-Through" Magic

The US LLC pays $0 corporate income tax.

The Result

100% of the tax obligation "passes through" to you, the individual investor.

The Paperwork

Every year (usually in March), the LLC issues a Schedule K-1. Think of this as your "annual report card" for the IRS. It tells you exactly how much profit (or loss) belongs to you.

The Golden Rule: You must report this income in your home country. Most countries have treaties to prevent you from paying full taxes twice, but you have to file correctly to get those benefits.

Country-Specific Tax Guides & Case Studies

France Tax Residents

Optimization is key: The difference between standard tax and "Micro-Foncier" is huge.

The Rules

- Standard Route: Rental income is added to your global income (taxed at 0-45%) plus 17.2% social charges.

- The "Micro-Foncier" Regime: If your gross rental income is under €15,000, you can use this regime. It gives you an automatic 30% deduction for expenses—you only pay tax on 70% of the income.

- Forms: Report on Form 2047 (Foreign Income) and Form 2042.

Case Study: The French Investor

- Annual Gross Income: $1,800 USD (~€1,518)

- Scenario: Investor is in the 30% tax bracket.

How to file a declaration in France

You must declare this income during the annual tax campaign (typically April–June).

- Website: Log in to your personal space on impots.gouv.fr.

- Forms: Use Form 2047 (pink form) to declare income received abroad. Transfer the totals to Form 2042 (main return).

- Note: Ensure you check the "Micro-Foncier" box if eligible to get the 30% automatic deduction.

Poland Tax Residents

The landscape is shifting: Flat tax vs. Capital Gains.

The Rules

- Rental Income: Private rental income typically enjoys a flat tax of 8.5% (up to 120k PLN) and 12.5% thereafter.

- The "Capital Gains" Risk: Some tax chambers classify US LLC income as "capital gains," taxed at a flat 19% (Belka Tax).

- Recommendation: Budget for 19% to be safe.

Case Study: The Polish Investor

- Annual Gross Income: $1,800 USD (~6,390 PLN)

How to file a declaration in Poland

Polish residents settle their taxes annually by April 30th.

- Website: Use the Twój e-PIT service on podatki.gov.pl.

- Forms: For capital gains/foreign passive income, you typically file PIT-38.

- Process: You can add the foreign income manually in the "Inne przychody" (Other income) section.

Netherlands Tax Residents

The "Box 3" system: You are taxed on value, not actual rent.

The Rules

- Box 3: You pay tax on a "deemed return" (fictitious profit) based on the value of your assets on January 1st.

- Threshold: If your total assets (minus debts) are under roughly €57,000, you generally pay €0 tax.

- Above Threshold: You pay ~36% tax on a deemed return of approx 6%.

Case Study: The Dutch Investor

- Investment Value: €25,000

- Actual Cash Received: €1,518 ($1,800 USD)

- Scenario: Investor has significant savings (Total assets > €57,000).

How to file a declaration in the Netherlands

The Dutch tax authority sends a letter inviting you to file, usually in March/April.

- Website: Log in to Mijn Belastingdienst at belastingdienst.nl.

- Section: Go to Box 3 (Savings and investments).

- Process: Declare the value of your foreign investment as of January 1st.

Germany Tax Residents

High precision, high compliance.

The Rules

- Classification: US LLC income is generally treated as foreign investment income.

- Tax Rate: 25% Flat Tax (Abgeltungsteuer) + Solidarity Surcharge.

- Allowances: The first €1,000 of investment income is tax-free (Sparer-Pauschbetrag).

📊 Case Study: The Berlin Investor

- Annual Gross Income: $1,800 USD (~€1,518)

- Scenario: Single investor, using the tax-free allowance.

How to file a declaration in Germany

- Website: Register at elster.de.

- Forms: Use Anlage KAP (Income from Capital Assets).

- Process: Enter your US LLC income in lines 14-19 ("Foreign capital income").

Australian Tax Residents

The "Foreign Hybrid" advantage.

The Rules

- Structure: The ATO typically views a US LLC as a "Foreign Hybrid Limited Partnership."

- Rates: Income is added to your assessable income (marginal rates 0-45%).

- CGT Discount: Hold tokens >12 months for a 50% Capital Gains Tax discount.

Case Study: The Aussie Investor

- Annual Gross Income: $1,800 USD (~$2,601 AUD)

- Scenario: Marginal tax rate of 32.5%.

How to file a declaration in Australia

- Website: Log in via myGov to access the ATO.

- Section: "Foreign income, assets and entities".

- Process: Report as "Foreign partnership income" or "Other foreign income."

Expats in Indonesia (Bali)

Worldwide income applies if you stay >183 days.

The Rules

- Rates: Progressive Personal Income Tax (PPh 21) from 5% to 35%.

- Conversion: Use Ministry of Finance rates on the date of receipt.

Case Study: The Bali Expat

- Annual Gross Income: $1,800 USD (~30.17 Million IDR)

- Scenario: 5% Tax Bracket (Income under 60M IDR).

How to file a declaration in Indonesia

- Website: Access DJP Online at pajak.go.id.

- Form: Form 1770 (Annual Tax Return).

- Section: "Income from Abroad" (Penghasilan Neto Luar Negeri).

Romania Tax Residents

One of the most favorable tax regimes in the EU.

The Rules

- Income Tax: Flat rate of 10% on foreign income.

- Health Contribution (CASS): May apply if total income exceeds 6/12/24 minimum wages (usually not applicable for small investments).

Case Study: The Bucharest Investor

- Annual Gross Income: $1,800 USD (~7,740 RON)

How to file a declaration in Romania

- Website: Register for the "Virtual Private Space" (SPV) on ANAF.

- Form: Declaratia Unica (Form 212).

- Section: "Venituri realizate din străinătate".

Ukraine Tax Residents

Standard rules apply: 18% PIT + 5% Military Tax.

The Rules

- Tax Rate: 18% Personal Income Tax + 5% Military Tax (Updated 2026).

- Reporting: Schedule K-1 income is considered "foreign source income."

Case Study: The Ukrainian Investor

- Annual Gross Income: $1,800 USD (~77,616 UAH)

How to file a declaration in Ukraine

Declarations are submitted annually before May 1st.

- Website: Use the Electronic Cabinet at cabinet.tax.gov.ua.

- Form: Select the "Declaration of Property and Income" (F0100214).

- Section: Enter the income in line 10.6 "Foreign Income".

Canadian Tax Residents

⚠️ Warning: The Hybrid Mismatch ⚠️

The Issue

Canada views US LLCs as Corporations, while the US views them as Partnerships. This mismatch can lead to the CRA taxing your income as "foreign dividends" while denying Foreign Tax Credits.

Advice

Do not invest large sums personally without a cross-border specialist's review. Effective tax rates can exceed 60-70% in worst-case scenarios due to double taxation.

📅 The Investor’s Tax Calendar

Keep these dates in your diary to stay compliant.

- January - December: You receive token distributions (Passive income phase).

- March 15 (Year 2): Binaryx issues your Schedule K-1 (US Tax Form).

- April - June: File your local tax returns in your home country using the K-1 data.

📂 Where to Find Your Tax Documents

Accessing your tax forms, including Schedule K-1, is straightforward on the Binaryx platform. How to find it on the platform - you can read the guide in the previous article.

Ready to get started? Join investors who are already earning passive income in dollars. Start building your future with minimal investment.

👉 Start investing with Binaryx Platform

Articles you may be interested in

.png)

.png)

.png)

.jpeg)

.webp)